Getting a personal loan doesn’t have to be complicated. If you’ve received an invitation from Discover Personal Loans, you’re already one step ahead.

This comprehensive guide walks you through everything you need to know about using your invitation number to apply at DiscoverPersonalLoans.com/Apply, from start to finish. Whether you’re consolidating debt, covering medical expenses, or financing a home improvement project, we’ll show you exactly how to get the funds you need—possibly as soon as tomorrow.

Let’s unlock your financial empowerment together.

Table of Contents

What Are Discover Personal Loans?

Discover Personal Loans is a lending service provided by Discover Bank, the same company known for the popular Discover credit card since 1985. These are unsecured personal loans, meaning you don’t need to put up your car, home, or other assets as collateral to receive funding. This makes them an accessible financial tool for many Americans who need cash but don’t want to risk their valuable possessions.

What sets Discover apart in the crowded personal loan marketplace is their commitment to transparency and customer-first policies. Unlike many lenders who pile on hidden charges, Discover Personal Loans come with zero origination fees, zero application fees, and zero late payment fees. Yes, you read that right—no fees at all. This fee-free approach can save you hundreds or even thousands of dollars compared to other lenders.

The loans feature fixed interest rates, which means your monthly payment stays exactly the same throughout your entire repayment period. No surprises, no rate fluctuations to worry about. You can borrow anywhere from $2,500 to $40,000, with flexible repayment terms ranging from 36 to 84 months (that’s 3 to 7 years). This flexibility lets you choose a monthly payment that fits comfortably within your budget.

Discover’s funding speed is another major advantage. Once you’re approved and accept the loan terms, you can receive your money as soon as the next business day. That’s incredibly fast compared to traditional bank loans that might take a week or longer. Plus, if you’re using the loan for debt consolidation, Discover can send payments directly to your creditors, simplifying the entire process.

The company maintains an A+ rating from the Better Business Bureau and offers dedicated customer service through phone support and a mobile app, so you can manage your loan anytime, anywhere.

Understanding Your Discover Personal Loans Invitation Number

If you’ve received a letter or email from Discover with an invitation to apply for a personal loan, you’re likely wondering what that invitation number means and how it benefits you. Let’s break it down.

What Is an Invitation Number?

An invitation number (also called an invitation ID) is a unique code that Discover sends to select individuals who meet their initial creditworthiness assessment criteria. Think of it as a VIP pass into the application process. Discover uses sophisticated algorithms to analyze credit bureau data and identify consumers who are likely to qualify for their loan products. If you received an invitation, it means Discover sees you as a potentially qualified borrower.

The invitation number typically consists of 10-16 alphanumeric characters and appears prominently on your invitation letter or email. It looks something like this: “ABC123XYZ789” (though your actual code will be different).

How Does the Invitation Number Help You?

Using your invitation number when you apply at DiscoverPersonalLoans.com/Apply offers several advantages:

- Pre-Qualification Benefits: Your invitation number indicates that Discover has already performed a soft credit check and believes you meet their basic eligibility requirements. This doesn’t guarantee approval, but it significantly improves your chances compared to applying cold without an invitation.

- Streamlined Application: When you enter your invitation number, some of your information may already be pre-populated in the application, saving you time and reducing the chance of data entry errors.

- Personalized Offers: Invitations often come with pre-qualified offers that show you estimated APR ranges and loan amounts based on your credit profile. This gives you a realistic preview of what you might qualify for before completing a full application.

- Soft Credit Pull Initially: Using an invitation typically means Discover won’t do a hard credit inquiry until you actually accept a loan offer, protecting your credit score during the shopping phase.

Where to Find Your Invitation Number

Your invitation number appears in different places depending on how you received your invitation:

- Mail Invitation: Look for a bolded or highlighted section on the first page of your letter, usually near the top or in a special box. It may be labeled as “Invitation Code,” “Invitation Number,” or “Invitation ID.”

- Email Invitation: Check the email from Discover (make sure it’s really from an official Discover email address). The invitation number is typically displayed prominently in the message body or in a special button/link area.

- Important: Never share your invitation number with anyone except when entering it directly on the official Discover website. Scammers sometimes try to collect these codes, so protect yours like you would a password.

If you’ve lost your invitation or can’t find the number, don’t worry. You can still apply for a Discover Personal Loan without it—you just won’t have the pre-qualification advantages. Call Discover customer service at 1-800-767-1823, and they can help you determine if you have an active invitation on file.

How to Apply for Discover Personal Loans: Complete Step-by-Step Guide

Applying for a Discover Personal Loan is straightforward, and you have two convenient options: applying by phone or online at DiscoverPersonalLoans.com/Apply. Both methods work well, so choose whichever feels more comfortable to you.

Option 1: Applying by Phone (Full Walkthrough)

Some people prefer speaking with a real person during the application process. Here’s exactly how to apply by phone:

Step 1: Gather Your Documents Before calling, collect these items to speed up the process:

- Your invitation number (if you have one)

- Social Security number

- Current employer’s name and address

- Monthly gross income (before taxes)

- Current housing payment (rent or mortgage)

- Driver’s license or state ID

- Bank account information (for funding)

Step 2: Call the Application Line Dial Discover’s dedicated personal loan application number: 1-800-767-1823. This line is open Monday through Friday, 8 AM to 11 PM Eastern Time, and weekends from 9 AM to 6 PM Eastern Time.

Step 3: Provide Your Invitation Number When connected with a customer service agent, let them know you have an invitation to apply and provide your invitation number. The agent will pull up your pre-qualification information.

Step 4: Answer Application Questions The agent will ask you a series of questions about:

- Your personal information (name, address, date of birth)

- Your employment situation and income

- Your housing status and monthly payment

- The loan (debt consolidation, home improvement, etc.)

- The loan amount you’re requesting

Be honest and accurate with all information. The agent is there to help, not judge, so don’t feel embarrassed about your financial situation.

Step 5: Income Verification Discover may verify your income through one of several methods:

- Third-party verification service (automated)

- Recent pay stubs (you’ll email or fax these)

- Bank statements showing direct deposits

- Tax returns for self-employed individuals

Step 6: Review Your Offer If pre-approved, the agent will present your loan offer, including:

- Your specific APR (interest rate)

- Exact loan amount approved

- Available repayment term options

- Your monthly payment amount for each term option

Take your time reviewing these details. Don’t feel pressured to accept immediately. You can ask the agent to email you the offer details to review later.

Step 7: Accept or Decline If you’re satisfied with the terms, you can accept the offer over the phone. The agent will finalize your application, and you’ll receive funding typically within one business day after acceptance.

Average phone application time: 15-25 minutes

Option 2: Applying Online at DiscoverPersonalLoans.com/Apply (Detailed Instructions)

The online application is perfect if you prefer working at your own pace. Here’s the complete process:

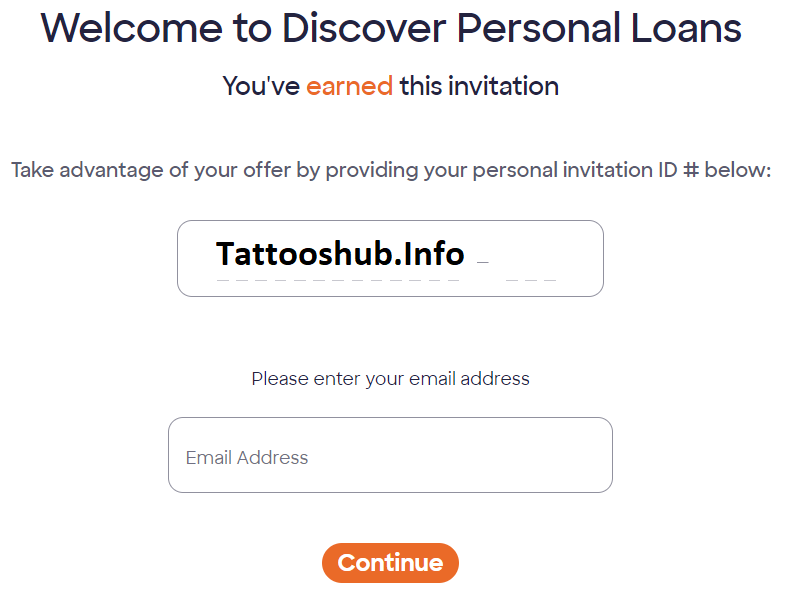

Step 1: Visit the Official Website Open your web browser and go directly to: www.discover.com/personal-loans

Make sure you see the secure padlock icon in your browser’s address bar, confirming you’re on the legitimate Discover website. Never click links from suspicious emails—always type the URL yourself.

Step 2: Click “Respond to Invitation” or “Check Your Rate” On the homepage, you’ll see two main options:

- “Respond to Invitation” (if you have an invitation number)

- “Check Your Rate” (if applying without an invitation)

If you have an invitation number, click “Respond to Invitation” to get the full benefits of your pre-qualification.

Step 3: Enter Your Invitation Details You’ll see a form requesting:

- Your invitation ID number (enter it exactly as shown on your invitation)

- Email address (use the same email where you received the invitation, if applicable)

- ZIP code

Click “Continue” after entering this information.

Step 4: Complete the Application Form The online form includes several sections. Fill out each one carefully:

Personal Information Section:

- Full legal name (first, middle, last)

- Date of birth

- Social Security number

- Current home address

- Phone number

- Email address

Employment Information Section:

- Employment status (employed, self-employed, retired, etc.)

- Employer name

- Employer address

- Job title

- Employment start date

- Monthly gross income (before taxes)

Financial Information Section:

- Housing status (own, rent, live with family)

- Monthly housing payment amount

- Other monthly debt payments

Loan Details Section:

- Desired loan amount ($2,500 to $40,000)

- Loan purpose from dropdown menu:

- Debt consolidation

- Home improvement

- Medical expenses

- Auto repairs

- Wedding

- Vacation

- Moving expenses

- Other major purchase

Step 5: Review and Submit Before clicking submit, carefully review all information for accuracy. Errors can delay approval or affect your interest rate. The system will perform a soft credit inquiry at this stage to generate your personalized offer.

Step 6: Receive Your Decision Most applicants receive an instant decision—you’ll see your results right on screen within seconds. Some applications require additional review and may take 1-2 business days for a final decision.

If instantly approved, you’ll see:

- Your approved loan amount

- Your specific APR

- Multiple repayment term options (36, 48, 60, 72, or 84 months)

- Monthly payment for each term option

Step 7: Choose Your Repayment Term Use Discover’s online calculator to see how different terms affect your monthly payment and total interest paid. Shorter terms mean higher monthly payments but less interest overall. Longer terms give you lower monthly payments but cost more in interest.

Step 8: Provide Final Documentation After selecting your preferred term, you may need to upload documentation for income verification:

- Two recent pay stubs, or

- Last two months of bank statements, or

- Most recent tax return (if self-employed)

Upload these documents directly through the secure portal.

Step 9: E-Sign Your Loan Agreement Review the loan agreement carefully, including:

- Final APR

- Total amount borrowed

- Monthly payment amount

- Payment due date

- Repayment term length

- Total interest you’ll pay

- Total amount you’ll repay

If everything looks correct, use your mouse or touchscreen to electronically sign the agreement.

Step 10: Provide Banking Information Enter your bank account details for loan disbursement:

- Bank name

- Routing number (9 digits)

- Account number

- Account type (checking or savings)

Discover will verify this information before sending funds.

Step 11: Submit Final Application Click the final submit button. You’ll receive a confirmation email with your loan details and funding timeline.

Step 12: Receive Your Funds For most borrowers, funds arrive in your bank account the next business day after final approval and e-signing. Some accounts may receive funds the same business day if everything is completed early in the morning Eastern Time.

Average online application time: 10-20 minutes

Required Documents Checklist for Both Application Methods

Print or save this checklist before applying:

- [ ] Government-issued photo ID (driver’s license, state ID, or passport)

- [ ] Social Security number

- [ ] Proof of income (pay stubs, bank statements, or tax returns)

- [ ] Current employer information (name, address, phone number)

- [ ] Residential address (proof may be requested)

- [ ] Bank account information for funding

- [ ] Invitation number (if applicable)

- [ ] List of current debts (if applying for debt consolidation)

Application Tips for Higher Approval Chances

Tip 1: Apply with accurate income information. Include all reliable income sources: salary, bonuses, investment income, retirement benefits, and side gig earnings.

Tip 2: Check your credit report before applying. Visit AnnualCreditReport.com for a free copy and dispute any errors that might lower your score.

Tip 3: Pay down credit card balances if possible. Lower credit utilization improves your credit score and makes you more attractive to lenders.

Tip 4: Apply during business hours. If you apply early in the day on a business day, you may get approved and funded faster.

Tip 5: Be honest about loan purpose. Discover tracks how funds are used (especially for debt consolidation), so accurately represent your intentions.

Complete Eligibility Requirements and Qualification Criteria

Understanding exactly what Discover looks for in borrowers helps you assess your chances before applying. Here’s everything you need to qualify.

Basic Age and Identity Requirements

- Minimum Age: You must be at least 18 years old (19 in Alabama and Nebraska, 21 in Puerto Rico). Discover verifies your age through your birthdate and may request your ID.

- U.S. Residency: You must be a U.S. citizen or permanent resident with a valid Social Security number. Discover does not offer personal loans to international students or temporary visa holders.

- Physical U.S. Address: You need a residential street address in the United States. P.O. boxes are not acceptable as your primary residence. Discover services borrowers in all 50 states and Washington D.C.

Credit Score Requirements

This is where many applicants worry, so let’s be clear about what Discover needs:

Minimum Credit Score: Discover requires a credit score of at least 660 to qualify. This falls into the “good credit” category on the FICO scale (which ranges from 300 to 850).

Here’s how credit scores typically break down:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 300-579

If your score is in the 660-680 range, you’ll likely qualify but may receive a higher APR. Scores above 720 typically qualify for Discover’s best rates.

What Discover Evaluates in Your Credit History:

Credit Activities: Discover examines your recent credit behavior, including:

- Payment history (do you pay on time?)

- Credit utilization (how much available credit are you using?)

- Length of credit history (how long you’ve had credit)

- Credit mix (types of credit you’ve managed)

- Recent credit inquiries (how many times you’ve applied for credit recently)

Negative Marks: Certain items on your credit report may hurt your chances:

- Recent bankruptcies (especially within the past 2 years)

- Active collections accounts

- Charge-offs or settled accounts

- Multiple late payments (30+ days) in the past year

- High credit card balances (using more than 50% of limits)

Credit Bureaus: Discover pulls reports from one or more of the three major credit bureaus (Equifax, Experian, TransUnion). They perform a soft pull initially for pre-qualification, then a hard inquiry when you formally apply.

Income Requirements

Minimum Income Threshold: Discover requires applicants to have a minimum income of $25,000 per year. This can be individual income or household income, depending on your situation.

Acceptable Income Sources:

- Salary or hourly wages from employment

- Self-employment income

- Retirement benefits (Social Security, pension, 401k distributions)

- Disability benefits

- Investment income (dividends, interest, capital gains)

- Alimony or child support (if you wish to have it considered)

- Spousal income (if married and combined household income is reported)

Income Verification Process:

Discover uses multiple methods to verify your stated income:

- Automated Verification: Discover partners with third-party services like Plaid or The Work Number that connect to payroll databases and banking systems. This is the fastest method—verification happens in seconds.

- Pay Stub Upload: If automated verification isn’t available, upload your two most recent pay stubs showing year-to-date earnings.

- Bank Statements: Provide 2-3 months of bank statements showing regular deposits from your employer or other income sources.

- Tax Returns: Self-employed individuals typically need to provide the most recent 1-2 years of tax returns (Form 1040 and Schedule C).

- Employer Contact: In rare cases, Discover may contact your employer directly to verify your employment status and income. They’ll ask for your HR department’s phone number.

Employment and Stability Factors

While Discover doesn’t specify a minimum employment length, they do evaluate your job stability:

Employment Status Accepted:

- Full-time employed

- Part-time employed (if income meets minimum)

- Self-employed or business owner

- Retired with sufficient income

- Unemployed with household income of $25,000+

Stability Indicators They Look For:

- Consistent employment history (preferably 6+ months at current job)

- Stable industry (less preference for seasonal or gig work)

- Verifiable employer contact information

- Regular, predictable income pattern

Debt-to-Income Ratio Considerations

While Discover doesn’t publish a maximum debt-to-income (DTI) ratio, most lenders prefer DTI below 40-43%. Here’s how to calculate yours:

DTI Calculation Formula: (Total Monthly Debt Payments ÷ Gross Monthly Income) × 100 = DTI%

Example:

- Monthly debts: $1,500 (mortgage, car loan, credit cards, student loans)

- Monthly gross income: $4,500

- DTI: ($1,500 ÷ $4,500) × 100 = 33%

A DTI of 33% in this example is healthy. If your DTI exceeds 45%, consider paying down debts before applying or requesting a lower loan amount.

Additional Eligibility Factors

- Active Bank Account: You need an active checking or savings account for loan disbursement and automatic payments. Prepaid cards or payment apps like Venmo don’t qualify.

- Valid Email Address: Discover communicates primarily through email for loan updates, payment reminders, and account management.

- Computer or Mobile Device Access: You’ll need internet access to complete the application and access your account through Discover’s website or mobile app.

State Restrictions and Licensing

Discover Personal Loans are available in all 50 states plus Washington D.C. However, maximum loan amounts may vary by state based on state lending regulations. Some states cap interest rates or loan amounts, which could affect your available loan options.

Comprehensive Benefits of Discover Personal Loans

Let’s explore exactly why thousands of Americans choose Discover Personal Loans over competitors. These benefits can save you money and simplify your financial life.

Zero Fees—A True Rarity in Personal Lending

Most personal loans come loaded with fees that increase your borrowing cost. Discover breaks the mold:

- No Origination Fee: Many lenders charge 1-8% of the loan amount just for processing your application. On a $15,000 loan, that could be $150 to $1,200 taken right off the top. Discover charges $0.

- No Application Fee: Some lenders charge $25-$100 just to apply, whether you’re approved or not. Discover charges $0 to apply.

- No Late Payment Fee: If you miss a payment due date (which we don’t recommend), Discover doesn’t pile on a $25-$50 late fee like most lenders. You’ll still owe the payment, but no additional penalty.

- No Early Payoff Penalty: Want to pay off your loan early and save on interest? Go right ahead. Discover doesn’t charge prepayment penalties, unlike some lenders who want to collect every dollar of interest they originally calculated.

- Real Dollar Impact: On a $15,000 loan, avoiding just a 5% origination fee saves you $750 immediately. Add potential late fees and prepayment penalties other lenders charge, and you could save over $1,000 by choosing Discover.

Competitive Interest Rates with Fixed Certainty

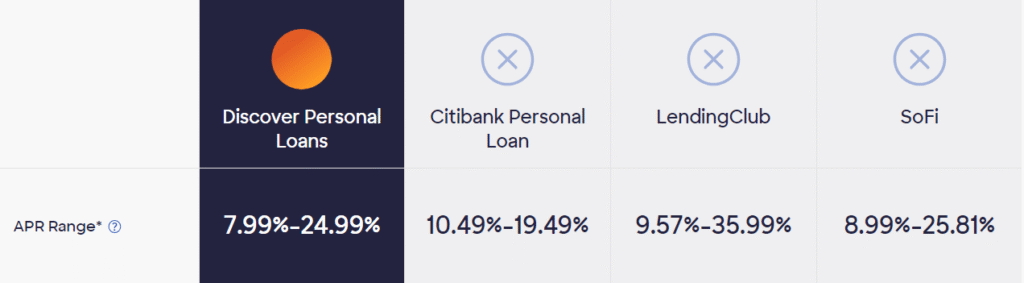

- APR Range: As of 2025-26, Discover Personal Loans offer APRs ranging from 7.99% to 24.99%, depending on your creditworthiness assessment.

- Fixed Rate Advantage: Your interest rate never changes throughout the loan term. Unlike variable-rate loans or credit cards where rates can jump unexpectedly, you have complete payment predictability. Your first payment and last payment will be exactly the same amount.

Rate Comparison Example:

| Lender Type | Typical APR Range | Origination Fee |

| Discover Personal Loans | 7.99% – 24.99% | 0% |

| Traditional Banks | 8.99% – 25.99% | 0% – 5% |

| Online Lenders | 7.49% – 35.99% | 1% – 8% |

| Credit Cards | 18.99% – 29.99% | Variable rates |

Notice that while some online lenders advertise lower minimum rates, they often charge hefty origination fees that increase your true cost. Discover’s combination of competitive rates and zero fees often makes them the most affordable option overall.

Lightning-Fast Funding Speed

- Next Business Day Funding: Once you accept your loan offer and complete all verification steps, Discover sends funds via ACH transfer to your bank account. Most borrowers receive money within one business day.

- Same-Day Possibility: If you complete your application, upload documents, and e-sign your agreement before 8 AM Eastern Time on a business day, some borrowers receive funds the same afternoon.

Comparison to Other Lenders:

- Traditional banks: 5-7 business days

- Credit unions: 3-5 business days

- Online lenders: 1-4 business days

- Discover: 1 business day typical

This speed matters when you’re consolidating high-interest debt or covering an emergency expense.

Flexible Repayment Terms

Choose the repayment term that fits your budget and financial goals:

Available Terms:

- 36 months (3 years)

- 48 months (4 years)

- 60 months (5 years)

- 72 months (6 years)

- 84 months (7 years)

How Term Length Affects Your Loan:

Let’s look at a $15,000 loan at 12% APR across different terms:

| Term | Monthly Payment | Total Interest Paid | Total Repaid |

| 36 months | $498.21 | $2,935.56 | $17,935.56 |

| 48 months | $395.01 | $3,960.48 | $18,960.48 |

| 60 months | $333.67 | $5,020.20 | $20,020.20 |

| 72 months | $296.66 | $6,119.52 | $21,119.52 |

| 84 months | $273.09 | $7,299.56 | $22,299.56 |

Choosing the Right Term:

- Shorter terms = Higher monthly payment but less interest overall

- Longer terms = Lower monthly payment but more interest overall

Choose a 36-48 month term if you can comfortably afford higher payments and want to save money. Choose a 60-84 month term if you need a lower monthly payment to fit your budget.

Direct Creditor Payment for Debt Consolidation

If you’re using your loan for debt consolidation, Discover offers a valuable service: they can send payments directly to your creditors on your behalf.

How It Works:

- During your application, indicate you’re consolidating debt

- Provide creditor names and account numbers

- Specify how much to send to each creditor

- Discover sends payments directly from your loan funds

- You receive remaining funds (if any) in your bank account

Benefits of Direct Payment:

- Ensures debt actually gets paid off (instead of temptation to spend the money elsewhere)

- Faster processing (creditors may receive payment within 5-7 days)

- Simpler process (you don’t have to write multiple checks or make multiple transfers)

- Immediate relief (you stop getting collection calls almost immediately)

- One simplified payment (instead of juggling multiple credit card due dates, you have one Discover payment)

Real-Life Example: Sarah had five credit cards with balances totaling $12,000 and interest rates between 19.99% and 27.99%. Her minimum payments totaled $380/month. She got approved for a $12,000 Discover loan at 13.99% APR for 48 months. Discover paid off all five cards directly. Now Sarah has one payment of $320/month, saving $60/month while paying off debt 2 years faster than making minimum payments.

Mobile App Convenience

Discover’s mobile app (available for iOS and Android) gives you complete loan management from your smartphone:

App Features:

- Check current loan balance

- View payment history

- Make one-time payments

- Change payment due date

- Set up automatic payments

- View upcoming payment amount and date

- Access digital statements

- Contact customer service via secure message

- Set payment reminders and alerts

- View remaining interest you’ll pay

The app receives 4.7/5 stars on Apple App Store and 4.5/5 stars on Google Play, with users praising its simplicity and reliability.

Flexible Payment Due Date

Unlike most lenders who assign you a due date, Discover lets you choose your preferred monthly payment date. You can even change it later if your financial situation changes.

How to Choose Your Due Date:

- Log into your Discover account online or via the app

- Navigate to “Payment Settings”

- Select your preferred due date (any date from the 1st to the 28th of the month)

- Confirm your choice

Strategic Date Selection:

- Choose a date a few days after your paycheck arrives

- Avoid end-of-month dates if you have other bills due then

- Pick a date that’s easy to remember (like the 1st or 15th)

You can change your due date once per year without penalty, giving you flexibility if your income schedule changes.

Excellent Customer Service Support

Customer Service Availability:

- Phone: 1-866-248-1255

- Hours: Monday-Friday 8 AM – 11 PM ET, Saturday-Sunday 9 AM – 6 PM ET

- Secure online messaging through your account

- FAQ database and help center

- Social media support (Twitter/X, Facebook)

Average Response Times:

- Phone: Less than 3 minute wait time (based on user reviews)

- Secure message: Within 24 business hours

- Social media: Within 2-4 hours during business hours

Discover’s customer service representatives are U.S.-based and trained specifically on personal loans, so they can answer detailed questions about your account.

Additional Benefits Worth Noting

- Soft Credit Check for Rate Checking: When you check your rate using your invitation number, Discover performs only a soft inquiry that doesn’t affect your credit score. The hard inquiry only happens when you formally accept the loan.

- No Mandatory Insurance: Some lenders pressure you to buy credit insurance or payment protection. Discover doesn’t require or aggressively sell these products.

- Transparent Terms: Your loan agreement clearly states all terms in plain language—no hidden clauses or fine print surprises.

- Financial Education Resources: Discover provides free financial education articles, calculators, and tools to help you make informed decisions.

Making Payments: Complete Guide to All Payment Methods

Once you have your Discover Personal Loan, you’ll make monthly payments until the loan is paid off. Discover offers multiple payment options for maximum convenience.

Setting Up Automatic Payments (Highly Recommended)

Automatic payments ensure you never miss a due date, which protects your credit score and keeps your loan in good standing.

How to Set Up AutoPay:

- Log into your Discover account at www.discover.com

- Click on “Personal Loans” in your account dashboard

- Select “Payment Options”

- Click “Set Up Automatic Payments”

- Choose your payment bank account

- Select payment amount:

- Minimum payment due

- Fixed amount (you specify)

- Full balance (pays off loan faster)

- Confirm your payment date

- Review and submit

AutoPay Benefits:

- Never forget a payment (set it and forget it)

- Money transfers automatically on your due date

- Can cancel or modify anytime

- Some borrowers enjoy the discipline of automatic debt reduction

Important AutoPay Notes:

- Ensure your bank account has sufficient funds before each due date

- You’ll receive email reminders 3 days before each automatic payment

- You can still make additional payments manually to pay off the loan faster

Making One-Time Online Payments

If you prefer manual control over each payment, you can pay online each month:

Online Payment Steps:

- Visit www.discover.com and log into your account

- Navigate to your Personal Loan account

- Click “Make a Payment”

- Enter payment amount (minimum payment or more)

- Select your bank account

- Choose payment date (today or schedule for future)

- Review details and submit

Payment Processing Time:

- Payments submitted before 5 PM ET process same business day

- Payments submitted after 5 PM ET process next business day

- Weekend payments process the following Monday

Payment Confirmation: You’ll receive an email confirmation within minutes of submitting your payment. Save these for your records.

Paying by Phone

Prefer to make payments over the phone? No problem.

Phone Payment Process:

- Call Discover’s payment line: 1-866-248-1255

- Follow the automated prompts, or say “Make a payment”

- Enter or say your account number

- Provide your bank account information

- Specify payment amount

- Confirm the payment

Automated System Features:

- Available 24/7 (even outside customer service hours)

- Quick and convenient (usually 2-3 minutes)

- Immediate confirmation number provided

Speaking with a Representative: If you prefer talking to a person, stay on the line or say “Representative” during the automated prompts. Representatives can answer questions while processing your payment.

Mailing Payment by Check

Old-school? You can still mail checks.

Mail Payment Instructions:

- Make check payable to: Discover Personal Loans

- Write your loan account number on the check’s memo line

- Include the payment coupon from your statement (if available)

Mail to:

Discover Personal LoansPO Box 30954Salt Lake City, UT 84130-0954

Important Mailing Considerations:

- Mail checks at least 7-10 days before your due date (postal delays can occur)

- Keep your check receipt as proof of mailing

- Discover doesn’t accept payment by money order or cash

- Payment posts to your account 3-5 business days after Discover receives it

Making Extra Payments to Pay Off Faster

Want to save money on interest? Make extra payments whenever you can.

Extra Payment Strategies:

- Strategy 1: Add to Monthly Payment: Instead of paying the $350 minimum, pay $400 or $450 each month. Even an extra $50/month significantly reduces your total interest.

- Strategy 2: Make Biweekly Payments: Split your monthly payment in half and pay every two weeks. You’ll make 26 half-payments per year (equivalent to 13 full monthly payments instead of 12), shaving months or years off your loan.

- Strategy 3: Apply Windfalls: Got a tax refund, work bonus, or birthday money? Apply it directly to your loan principal.

Example of Extra Payment Impact:

- Original loan: $15,000 at 12% APR for 60 months

- Monthly payment: $333.67

- Total interest: $5,020.20

If you add just $50 extra per month ($383.67 total):

- Loan paid off in: 48 months (1 year early!)

- Total interest: $3,877.15

- Interest saved: $1,143.05

Payment Allocation and Principal Reduction

How Discover Applies Your Payment: Each monthly payment is divided between:

- Interest (calculated on your remaining balance)

- Principal (the actual loan amount you borrowed)

Early in your loan, more money goes toward interest. As the balance decreases, more goes toward principal. This is called amortization.

Extra Payments Go Directly to Principal: When you pay more than the minimum, the extra amount reduces your principal balance immediately, which lowers the interest calculated on future payments.

Payment Due Date Rules

Grace Period: Discover doesn’t advertise a grace period, so consider your payment due on your selected due date.

Payment Options

Managing your Discover Personal Loan repayment is straightforward with multiple convenient payment methods designed to fit your lifestyle and preferences. Understanding these payment options helps you maintain a positive payment history and avoid any potential issues with your loan account.

Online Payment Methods

The most popular and convenient way to manage your Discover Personal Loan payments is through their digital platforms.

Once your loan is funded, you can access your account through the Discover website or their Financial Services mobile app. The online payment system allows you to schedule one-time payments or set up automatic monthly payments directly from your checking or savings account. This direct payment method ensures your payment arrives on time every month without the need to remember due dates or worry about mail delays.

The mobile app provides additional flexibility for borrowers who prefer managing their finances on the go. You can check your account balance, view your repayment term progress, make payments, and even adjust your payment due date through the app interface. The system processes payments quickly, typically reflecting in your account within one to two business days.

Phone Payment Options

If you prefer speaking with a customer service agent or need assistance with your payment, Discover offers phone payment services. You can call their dedicated loan servicing number and work with a representative to process your payment over the phone. This option is particularly useful if you have questions about your payment amount, need to discuss payment arrangements, or want confirmation that your payment was received.

Phone payments can be made using your checking account information or through other approved payment methods. The customer service team is available during extended business hours to accommodate various schedules, making it easier for borrowers to manage their ongoing costs regardless of their work schedule.

Mail Payment Process

For those who prefer traditional payment methods, Discover accepts payments by mail. When making payments by mail, you should send a check or money order to the address provided on your monthly statement. It’s important to include your account number on the payment to ensure proper processing and avoid any delays in crediting your account.

Keep in mind that mail payments require additional processing time compared to online or phone options. You should mail your payment at least 5-7 business days before your due date to ensure it arrives on time. This helps you avoid any potential late payment issues and maintains your positive credit history with the credit bureaus.

Frequently Asked Questions

What is a Discover Personal Loans invitation number and why did I receive one?

It’s a unique code sent to pre-qualified customers, indicating they may qualify for a loan offer from Discover. It helps streamline the application by pre-populating some information and showing personalized loan terms.

How do I apply for a Discover Personal Loan using my invitation number?

You can apply online at DiscoverPersonalLoans.com/apply by entering your invitation number, or apply via phone with a representative. Both methods often result in same-day approval.

What credit score is required to qualify for a Discover Personal Loan?

A minimum credit score of 660 is typically required, but higher scores improve your chances of approval and better loan terms.

How long does the approval process take and when will I receive my funds?

Approval often takes a few hours, and if approved, funds can be sent as soon as the next business day.

Can I use my Discover Personal Loan for debt consolidation?

Yes, debt consolidation is a common use. You can even have Discover pay your creditors directly.

Are there any fees associated with Discover Personal Loans?

No. Discover charges no origination fees, late fees, or prepayment penalties.

What documents and information do I need to apply?

You’ll need personal ID (e.g., Social Security number, driver’s license), income details (e.g., pay stubs, tax returns), and bank information (routing/account numbers). If you have an invitation number, it will help pre-fill some info.

How does Discover Personal Loan compare to other personal loan lenders?

Discover offers competitive rates (7.99%-24.99%), no fees, fast approval, and excellent customer service. Their flexible repayment options and quick funding make them a top choice for many borrowers.

Conclusion

Applying for a Discover Personal Loan through DiscoverPersonalLoans.com/apply with your invitation number offers a streamlined path to securing the funds you need for various financial goals. Whether you’re consolidating high-interest debt, funding a home improvement project, covering medical expenses, or financing other important life events, Discover provides a transparent, fee-free borrowing solution with competitive interest rates and flexible terms.

The combination of no origination fees, no late fees, fast approval processes, and next business day funding makes Discover Personal Loans an excellent choice for borrowers who value efficiency and cost-effectiveness. With loan amounts ranging from $2,500 to $40,000 and repayment terms extending up to 84 months, you have the flexibility to customize your loan to fit your specific financial situation and budget.

If you’ve received an invitation number, take advantage of this pre-qualified offer to check your personalized rates without impacting your credit score. The application process is straightforward whether you choose to apply online through their user-friendly website, via their mobile app, or by speaking with a customer service agent over the phone. With a minimum credit score requirement of 660 and a $25,000 annual income threshold, many borrowers find themselves eligible for this financial tool.

Ready to take the next step? Visit DiscoverPersonalLoans.com/apply today to begin your application, or call Discover’s customer service team to speak with a representative who can guide you through the process. Remember to have your invitation number ready to expedite your application and access your pre-qualified terms. Start your journey toward financial empowerment and achieve your goals with a Discover Personal Loan that works for your unique needs and circumstances.